Donating art? IRS requires proper appraisal

Be it downsizing, debt or some other factor that may prompt one to consider donating art or antiques, Art Markets columnist Mary Manion offers a friendly reminder of the importance of appraisals in meeting tax requirements of donations.

By Mary Manion

The Three Ds, a market industry idiom for Death, Debt and Divorce, is a recurrent theme auction houses hear when collectors bring their art to market. As an appraiser, valuating estate and divorce settlements are needed to assist in the valuation of the property.

Another D to the alliteration could be for Downsizing, a growing trend for collectors who have run out of wall space and want to acquire more desirable works.

The International Society of Appraisers added Disaster to the pithy Three Ds, and in this type of

appraisal, usually required by insurance companies, two values are determined: the current replacement value of the artwork as if it was undamaged and the value of the artwork in its damaged state. Sometimes, as in the case of fire, the value is zero because the artwork no longer exists. In the latter instance, the appraiser employs what is called a hypothetical condition to determine value.

Another rising trend brings us yet to another D – Donation.

Appraisals for donation purposes are required by the IRS when the donor reports the gift on the current year-end tax return. This year saw an increase in last-minute donation appraisals in part, perhaps, because of the IRS requirement that the donation and the appraisal report must have been completed within 60 days of filing.

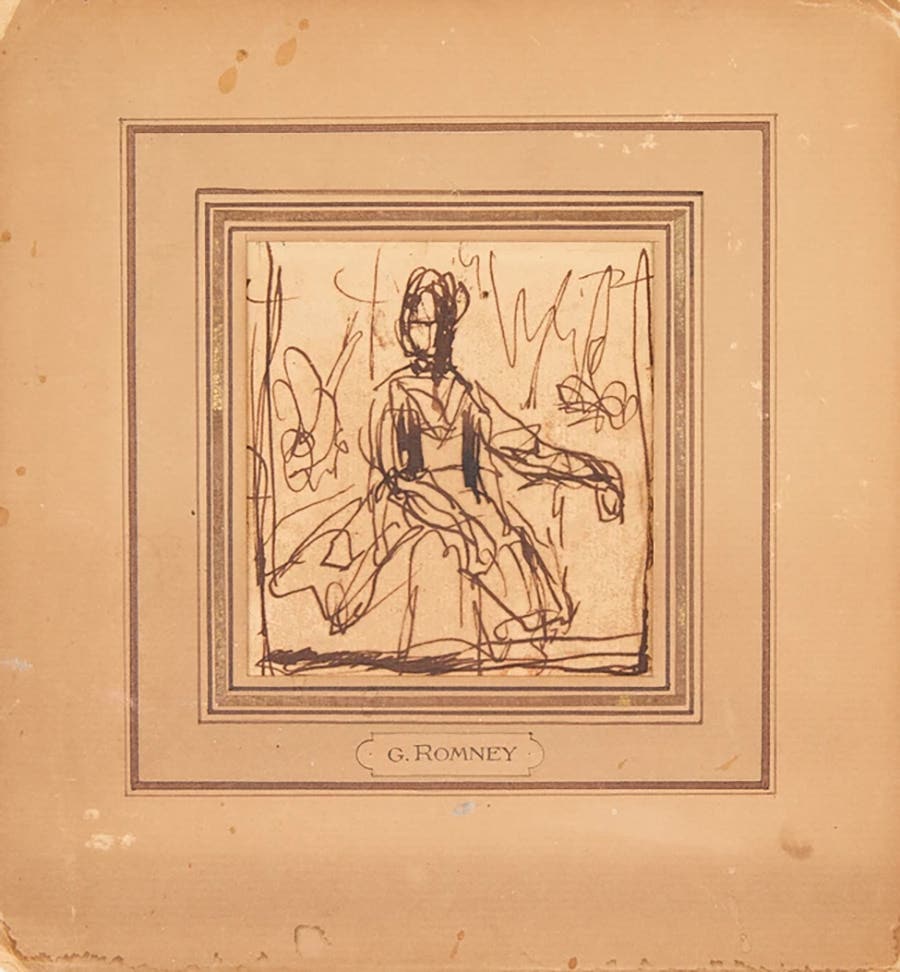

Several of my clients called within two months of the 2015 tax year deadline, only two weeks before the April tax date. One client brought a large collection of early 20th century oil paintings and watercolors that I had appraised for his insurance five years ago. He had decided to donate a significant part of his collection to four museums. The artwork had to be re-evaluated, as markets can change and in the current market, numbers can decrease. I needed to re-visit the collection, checking for condition and other variables that can alter the value of the work. It’s important to assess whether artwork is stored in less-than-ideal locations. Damp basements can cause mold to form inside a framed artwork and on the back of canvases. Attics with excessive dry heat can damage paint, causing cracks and ultimately paint loss. Fortunately, the client’s collection was displayed throughout the walls of his home.

When writing the report, which included auction results from the past year and a brief summation of the artist’s oeuvre including exhibitions at museums and galleries, it was determined that the values of each of the paintings and works on paper had remained stable from five years ago; the watercolors rose in price thanks to a favorable auction result just prior to my evaluation. A separate appraisal had to be completed for each museum receiving a donation. An interesting aside: When the client shared the appraisal report with one of the museums, the curator commented that he thought the value must surely be much higher. My client responded correctly, saying current market sales are what determine value.

The old adage in the appraisal business that a willing seller and a willing buyer set the price. Believing a painting is worth a large sum and actually plunking down the money are unrelated and not meaningful in the appraisal business.

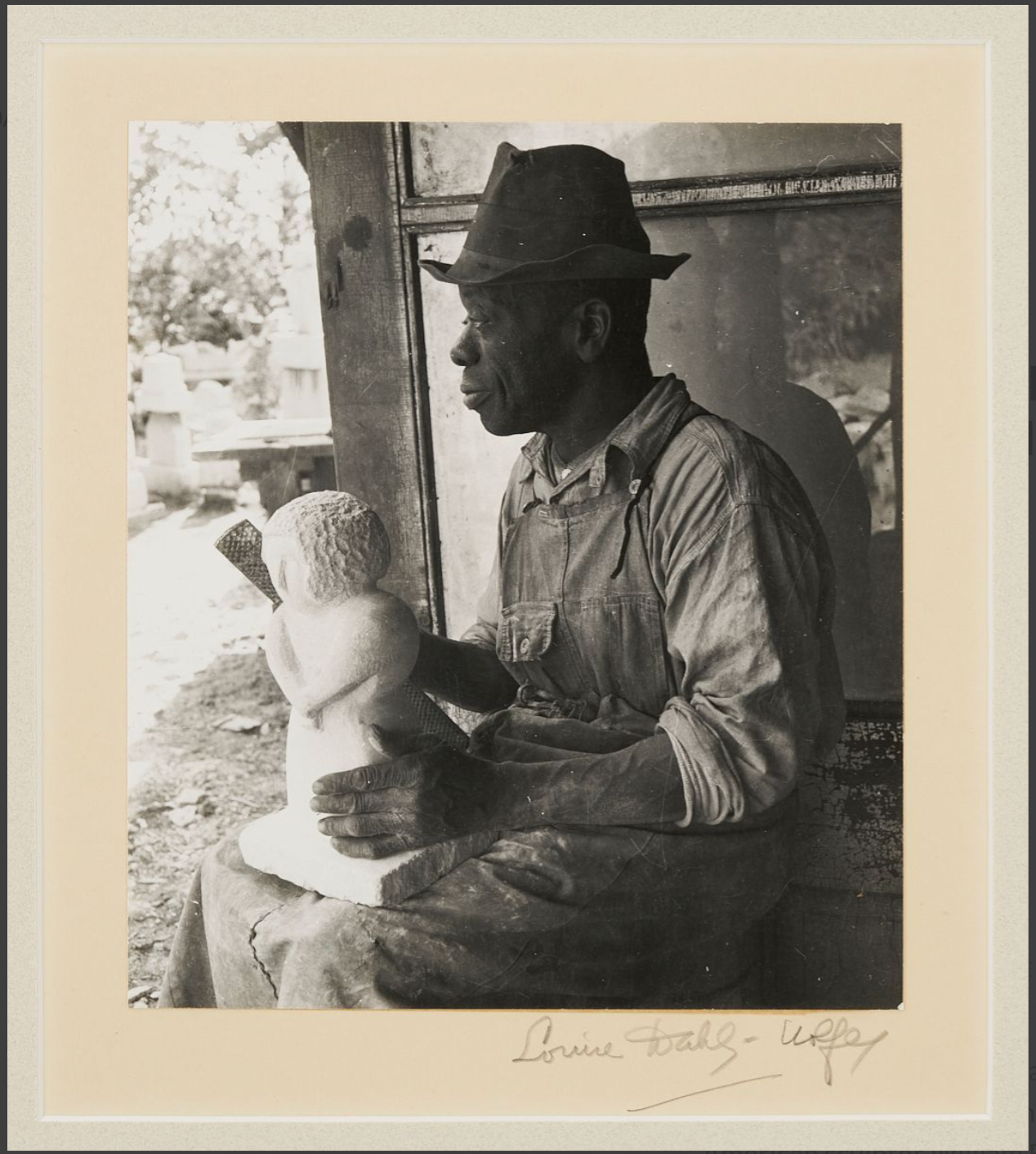

In recent years, appraisal requests for donations have increased significantly. Although a tax deduction can be beneficial, in many instances the modest value doesn’t warrant the bother. Many clients inherit artwork from their parents’ estate and having never liked the artwork, pack it up with the rest of the contents of the house and consider its disposal. Or the parents inquire about selling their artwork because, they say, “the kids don’t want it.” And often, after researching the artwork, it becomes apparent that there are no marketplace offerings of the artist one wants to sell and no auction sale history. It is not a straightforward process to sell artwork on demand. These days, the first thing people do when they want an idea of the value of their artwork is to look it up on the internet. If the artist has a presence online, and you can correctly identify what you have, you can get a sense of value. If nothing comes up, it probably has nominal value.

This article originally appeared in Antique Trader magazine

Learn about subscribing to Antique Trader magazine for just $26 a year for a print subscription (delivered about twice a month) or $20 for a one-year digital subscription.

The motivation to donate rather then sell is becoming popular because to sell the artwork involves cost and effort to find a buyer. If a gallery accepts artwork on consignment, current fees can be 50 percent or higher of the gallery’s established retail price. Often consignment contracts include a minimum length of time in which to display the artwork.

Managing your own online sale of artwork has the advantage of a large audience but disadvantages include securing the artwork for transport – tricky business with glass and shipping costs that escalate with size. My last-minute donation client had a collection of framed watercolors and posters with aesthetic worth but nominal retail value. He found a health care facility that was pleased to accept the artwork. Although the appraised fair market value of his collection was less than he had desired, he was pleased nevertheless to know his artwork was appreciated by others.

A frequent question concerns who is certified to make appraisals. The IRS requires a declaration from the appraiser stating that they have earned that designation from a professional appraiser organization, demonstrating competency in valuing the type of property being appraised or has at least met certain minimum education and experience. There are various standards used in the professional appraisal business. The most recognized is USPAP (Uniform Standards of Professional Appraisal Practice). To achieve this status, the appraiser must complete a 15-hour course study and pass an exam. The Appraisal Foundation, a not-for-profit organization authorized by Congress, promulgates USPAP, which requires appraisers to renew their certification.

Good appraisers arrive at their numbers carefully by conducting research, including records of sale or comparables if no sale records are available. They must maintain work files and be prepared to defend their results if called upon to do so.

Sometimes they must also be prepared to disappoint clients who dreamed their artworks are worth more than the market will bear.